The Budget of 2016-17, improvised the ways for new employment by implementing a vision, in order to incentivize creating new jobs in the formal sector, The Government of India will pay the Employee Pension Scheme(EPS) contribution of 8.33% for all the new employees enrolling in EPFO for the first three years of their employment. This will motivate the employers to recruit unemployed persons and also to bring into the books the informal employees and the government will pay them for this move. To channelize the whole movement and to avoid intermediation towards reaching the goal, this scheme is implemented to those who have salaries up to 15,000/- a month. This scheme has a provision of around thousand crores already.

This type of incentivized schemes will encourage the employers to employ new skilled or semi-skilled unemployed people and will establish a new order of workers in the country. The contribution of 8.33% of EPS for the new employment is a direct way to increase the employment and the government will have an official record of informal employees. The direct benefit of social security is one of the benefits for the newly employed workers an that too of an organized sector. For the textile sector, Ministry of Textile the Government of India will also pay 3.67% of the EPF contribution for the eligible employer.

PM Rojagar Yojana Scheme Details

Rojgar Protshahan Yojana Scheme Benefits Features Apply Online

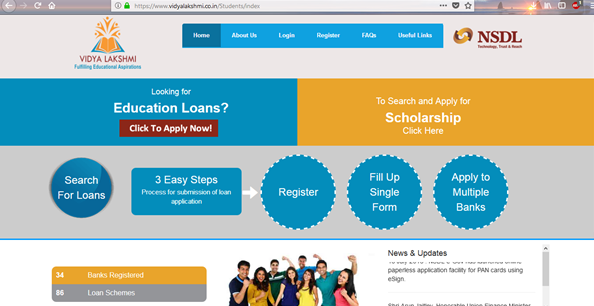

The employers must have Labour Identification Number, under Shram Suvidha scheme (https://shramsuvidha.gov.in) for any further participation in the PMRPY scheme.

-

Only new employees entered after 1st April 2016 will be eligible for this scheme i.e. if the company had 60 employees in March 2016 and 70 employees in the month of May 2016, only the 10 employees recruited after April 2016 will be eligible in PMRPY scheme. That much number of new employees will be helpful for the employer to participate in the scheme.

-

Employers must have the registered Organizational PAN number, Valid Bank account details etc for participating in the scheme.

-

This scheme incorporates only the new employees earning less than 15,000/- a month and not more than that. So, the new employees earning more than 15,000/- a month are not eligible for the scheme, also not for the employer.

-

Aadhar seeded Universal Account Number (UAN) is mandatory to connect with this scheme. if the employees are not on EPFO portal, as a registered employee it is responsibility of the employee to register them on EPFO online portal.

-

The Government of India will contribute the 8.33% to the employer for these newly recruited employees for the next 3 years. As soon as the employer has remitted the 3.67% of EPF contributions for these new employees each month i.e. total 12% (3.67 EPF by the employer & + 8.33% EPS by the Government)

-

Around 30 lakh beneficiaries are added under this scheme PMRPY with expenditure of 500 crores. The government has decided to give full 12% of contribution to the textile sector in the upcoming years.

National Industrial Classification (NIC) numbers covered by this particular component are as follows.

NIC 1410: MANUFACTURING OF WEARING APPARELS EXCEPT FUR APPARAELS

-

NIC 14101: Manufacturing of all kind of textile garments and clothing

-

NIC 14102: Manufacturing of raincoats of waterproof textile fabrics / plastic sheets

-

NIC 14105: Custom tailoring

-

NIC 14109: Manufacturing of wearing apparel not elsewhere found

NIC 1430: Manufacture of Knitted and crocheted apparel

-

NIC 14301: Manufacture of knitted and crocheted wearing apparel and other made up articles directly in to shape (pullovers, jerseys etc)

-

NIC 14309: Mfg. of Knitted and crocheted apparels including hosieries

NIC 1392: Manufacture of made up textile articles except wearing apparels

-

NIC 13921: Manufacture of curtains, bed covers and furnishings

Modi Rojgar Yojana Apply Online

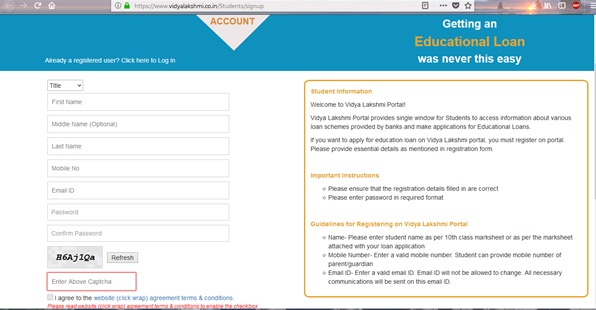

For the participation process the employer must follow the link (https://pmrpy.gov.in/) and fill in the credentials like organizational PAN number, Aadhar, EPFO/LIN number or id. Fill in the application form that appears after logging in. Once logged in, this form must be submitted by the employer on or before 10th of the following month. The employer can submit the application form only after the contribution of the 3.67 % EPF with respect to the new Employees.

Following is the official link for any further guidance.

(https://labour.gov.in/sites/default/files/PMRPY%20Revised%20Guidelines%20ver%202-1%20(2).pdf)