pmegp loan details: PMEGP loan yojna was launched in 2008 by indian Government. PMEGP stands for getting a Loan. PMEGP is also known as credit linked subsidy program. PMEGP yojna is the combination of REGP (Rural Employment Generation Program and PMRY (Pradhan Mantri Rozgar Yojna). it was established by KVIC (‘Khadi’ and ‘Village’ industries Commission) and directed by KVIC (Khadi & Village Industries Commission) directorates.

pmegp loan online application status

PMEGP Loan Yojna stands for giving a loan to Indian people for its enterprise. Through PMEGP scheme you can get loan up to 10 lakh to 25 lakh. the main purpose of PMEGP scheme is to available new employment to the jobless people. people may encourage by this PMEGP yojna.

The government wants to help to Jobless people for starting a new business and jobless people can be free from unemployment because government believes if our country stayed unemployment so that cant be starch ahead. The government believes that our youngster have lots of talent for starting a new business but because of less money they cant start a new business. but now it cant happened because of Indian government’s PMEGP loan. Due to PMEGP scheme, Youngster can start new business. Now Government’s aim to provide loan to youngster.

Eligibility Criteria for Applying loan in PMEGP Yojna

Apply for loan, you have to eligible for it and eligibility for PMEGP loan yojna is below:

- Which people have a age up to 18 that people can be apply for PMEGP Loan Yojna.

- For PMEGP scheme, you have to passed out minimum 8th Standard.

- Loan Application were accepted for new business, cant be accepted for old business.

- You are eligible when total cost of manufacturing cost is 25 lakh or total cost of business service project is 10 lakh.

- If you were applied for any other Yojna such as PMRY, REGP that time you cant taken any advantage from PMEGP yojna and you are not eligible for applying Loan application in PMEGP Yojna.

- In PMEGP yojna, your annual income detail are not considered.

PMEGP Loan Documents

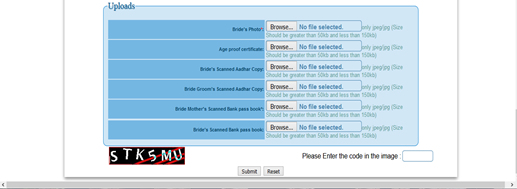

- Aadhar Card

- Pan Card

- Voter Id

- Passport size Photograph

- Bonafied Certificate

How much loan Get From PMEGP scheme Category wise

If you are eligible for PMEGP Loan, you will get detail about how many loans can get from PMEGP Scheme.

| Area | Subsidy | Promoter’s contribution | ||

| Women, SC/ST, OBC, Physically Handicapped, Ex-Serviceman | Others | Women, SC/ST, OBC, Physically Handicapped, Ex-Serviceman | Others | |

| Urban | 25 % | 15 % | 5 % | 10 % |

| Rural | 35 % | 25 % | 5% | 10 % |

pmegp online application: How to Apply for PMEGP Loan or Application Form of PMEGP Loan Yojna

Steps for applying in PMEGP scheme :

- First of all Open, the KVIC published PMEGPe portal on your Mobile browser or computer browser.

- Then you will see opened Application Form.

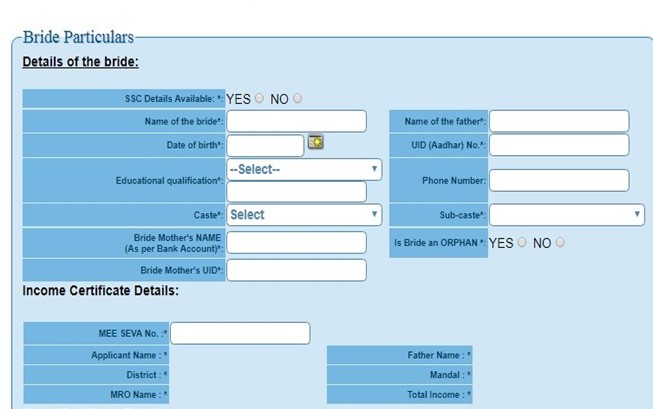

This form contains some information are below :

- Aadhar Card No: Where type your Aadhar Number.

- Name of Applicant: where type your full name.

- Validate Aadhar: Click on this button and get OTP on your mobile. then enter the OTP and validate your Aadhar card.

- Sponsoring Agency: Select any one option from the KVC, KVIC or DIC.

- State : Here type the name of state where you want to do business.

- District: Choose a district.

- Sponsoring Office : Choose the Office from the list.

- Legal Type : INDIVIDUAL

- Gender : Choose your gender.

- Date of Birth (dd-mm-yyyy) : write your birth date and then automatically age will be displayed on the Age Box.

- Social Category: choose the category. if you are Ex-serviceman, Physically Disabled, Hill border region, northeast region then you select the special category.

- Qualification: where select your qualification.

- Communication Address: where to write your residential address. fill up these field Mobile No, PAN and Email-Id.

- Unit Location: Choose the location where you want to business Urban or Rural.

- Proposed Unit Address: Type the address where you want to business.

- Type of Activity: here write your business type.

- Industry / Activity Name (Product Description) : write about your business shortly.

- EDP Training Undergone: If you EDP trained then click yes.

- EDP Training Instn. Name: Type name of your training center.

- Project Cost: Type total cost of the Business.

- 1st Financing Bank: Here choose the bank and IFSC code. click on the button ‘Save Application Data’ , when your all details are filled up. now you have to need your original document for final submission.

- Alternate Financing Bank Name: This is optional. choose the other bank.

3. Here fill up the PMEGP loan online application form. here send your approval to the district office. then after send to your bank for checkout. you can track your PMEGP loan online application status by PMEGP e tracking.

4. Contact with you after PMEGP loan Application reach in the bank. carry all the original document and go there, where check your original document. if your document is right then after you get the loan for new business.

Here, Provide the Direct link for applying in PMEGP Loan Yojna.

Apply For Loan – Click Here…

PMEGP Eligible Work criteria List

For which type of work or business, Indian Government gives Loan through PMEGP Loan Yojna. how many works can be done by using PMEGP Loan Scheme , that work list is below.

Which Type of work can be done through PMEGP Loan :

- Mineral Based

- Forest Based

- Poly and Chem

- Agro and Food

- Hmpi and Fibre

- Rebt

- Service and Textile

PMEGP Login

PMEGP Login is reliable with the applied banks only. you can check the lists of bank available on their official website. PMEGP doing such work are Goldsmith, Idol Making, Steam Coal Powder, Limestone Lime shell and other Lime products industry, Stone Cutting, Manufacturing / Processing Marble Sheets / Tiles (Simple / Mosaic etc…), Cottage Pottery Industry, Ceramic Dental Teeth, Clay Grinding, Blue Metal Jelly (Excavation of Stone Quarries for crushing of blue metal jelly), Utility articles made out of stone, Black Board / Chalk Making / Slate Making / Slate Pencil, Manufacture of plaster of paris utensil washing powder, Jewelry out of Gold, Fuel Briqueting, carpentry, Motor Winding, Iron grill making, Stove Wicks, Blacksmithy, Manufacture of Household aluminium utensils, Manufacturing of control panels, Manufacturing of Microscopes, Production of Radios, Solar and Wind energy implements, Kamble weaving, Printing Press / Screen Printing, Solar Charkha, Manufacturing of Shopping Bags, Xerox center, Cycle Repair Shops.

You can also see Detailed work list Regarding PMEGP Loan Yojna.

PMEGP Eligible Work Criteria List: Click Here…

If you have any doubt to apply to the PMEGP Loan Yojna, you can contact us by registering your Email-id and Phone Number on this site.